The Pandemic’s End Means Millions will Lose Insurance Beginning April 1

States have let people stay on their Medicaid roles and the federal government has paid the states to do that even if those people might no longer have been eligible. That is all coming to an end soon and the states are going to have to re-qualify or disqualify millions of people for whom they had been providing healthcare at little or no cost. How many people are affected by this? Over 87 MILLION people will need to be requalified.1 It is expected that “[b]etween 5.3 million and 14.2 million low-income people could lose Medicaid coverage following the end of the public health emergency and federal continuous enrollment requirement, KFF [Kaiser Family Foundation] researchers find in a new analysis. We arrive at those estimates after examining two potential scenarios about how states might manage the resumption of eligibility redeterminations and disenrollments.”2 [emphasis added] We’ll go into detail about that in another post, but here are your action items:

STEP ONE: Check if Your Insurance comes from Medicaid

If you know you are on Medicaid, go on to the next heading. If you think you aren’t on Medicaid — DOUBLE CHECK. Medicaid is known by a slew of other names and it is often confused with Medicare. Example: a member in California has a Kaiser insurance card — but he’s on Medi-Cal which is Medicaid. Here’s a list of SOME of the other names: https://www.medicaidplanningassistance.org/state-medicaid-resources/. If your insurance is on that list you are on Medicaid and you need to go to the next heading.

Even if you don’t recognize any of the names, make certain you aren’t on Medicaid by calling your insurance company. Your insurance card probably doesn’t say “Medicaid” and may not indicate those other names either since most states contract with a commercial insurance company or companies (such as Kaiser) to provide coverage. Call the info number on your insurance card and ask if your policy is a Medicaid policy. If they say no you can stop reading this post. Your coverage won’t be affected by the Medicaid unwinding.

STEP TWO: Find Your State’s Medicaid Information Page

You need to check eligibility requirements and make sure the state has the correct contact info for you. Using YouTube or social media for answers on this is a good way to lose your insurance. Find the official information, including eligibility requirements (they are different for every state) and how to contact the right state agency at: https://www.medicaid.gov/about-us/beneficiary-resources/index.html#statemenu.

STEP THREE: Check if You Are Still Eligible for Medicaid in that State

A lot of things changed during the years of the pandemic — and changes in your life could put your eligibility in doubt. These are only some of them: Did your minor child turn 18? Did you have a baby? Did you marry or divorce? Did you have different paid work or get a raise? Did you buy or were you given a vehicle? Did you move to another state or get a driver’s license or register to vote in another state? Did you work in another state? Have you been out of your state for months at a time? Did you buy a vehicle or land? Did you inherit or get gifted money or other assets?

Don’t assume the state won’t know — they now use data from Equifax to verify eligibility. It’s pretty extensive:

Helping Deliver Benefits Faster to Those in Need

ICI brings together the power of The Work Number and other Equifax data sources into one delivery platform to help streamline the benefit eligibility process. Verify benefits applications including address, incarceration status and income and employment information.

Add-on modules complement ICI with line of sight to owned properties, financial account information and applicant inquiry history. [https://www.equifax.com/business/product/instant-client-insights-eligibility/]

Check your state’s eligibility requirements (they are VERY different in different states) Call the state agency that runs medicaid if you have questions about eligibility. Eligibility info and where to call with questions can be found at https://www.medicaid.gov/about-us/beneficiary-resources/index.html#statemenu.

STEP FOUR: Update Your Contact Info With the State Agency

At some point (and there is no telling when) you will get a notice or notices and you will have perhaps 30 days to respond. Not responding or responding late can cause your insurance to be cancelled even if you completely qualify for Medicaid. If they don’t have a good address and other contact info for you, you’re likely to miss the memo. Don’t wait. Update your contact info right now. You can find how to contact your state agency at https://www.medicaid.gov/about-us/beneficiary-resources/index.html#statemenu.

STEP FIVE: Watch your USPS Mail, E-Mail, Phone, and Text Messages!

Again, you won’t have a long time to respond to a notice, so make sure you get it and get it right away. That gives you time to get documentation, contact the agency, etc., if there’s a problem. Some people won’t receive a notice for nearly a year, others may get them right away. Every state notifies in a different way — some only use USPS, others use electronic communications.

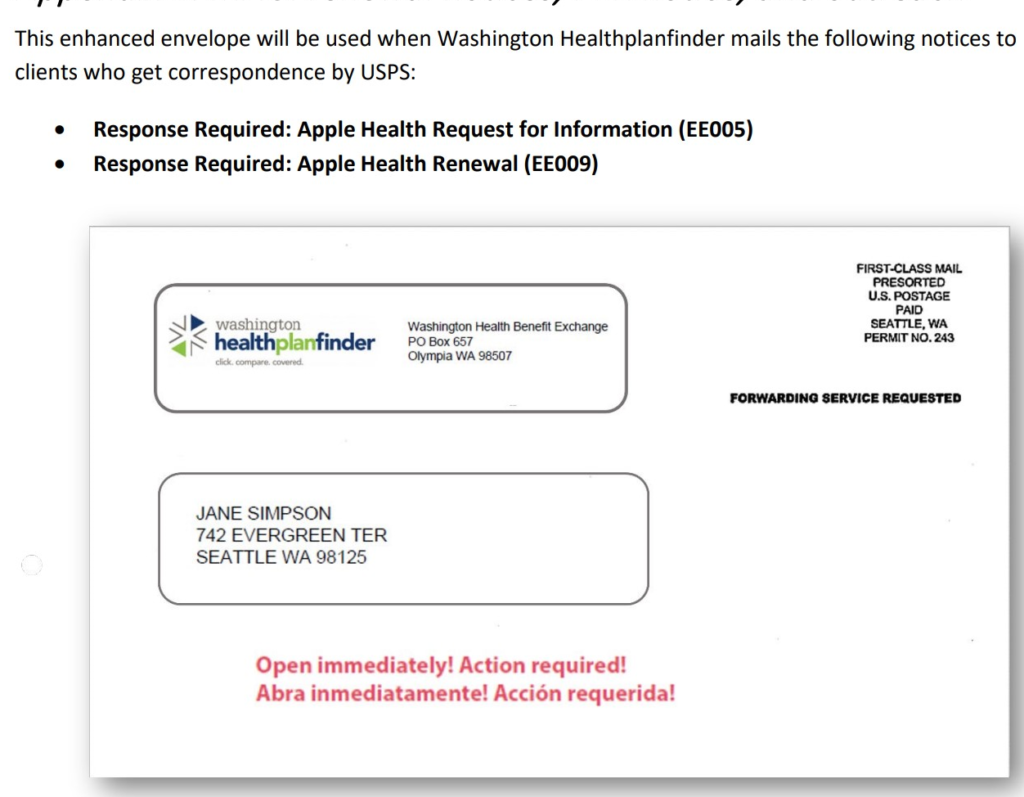

Also note that the notice may not be clearly marked as regarding Medicaid. For example, if you are from Washington state you may get a mailed notice that doesn’t mention “Medicaid” or “Apple Health” (their name for Medicaid) on its face. Instead it says “Washington Health Plan Finder” and “Washington Health Benefit Exchange.”

1https://www.medicaid.gov/medicaid/program-information/medicaid-and-chip-enrollment-data/report-highlights/index.html

2https://www.kff.org/medicaid/press-release/kff-analysts-find-that-between-5-3-million-and-14-2-million-people-could-lose-medicaid-coverage-following-the-end-of-the-public-health-emergency-and-continuous-enrollment-requirement-with-an-unknown/

Recent Comments